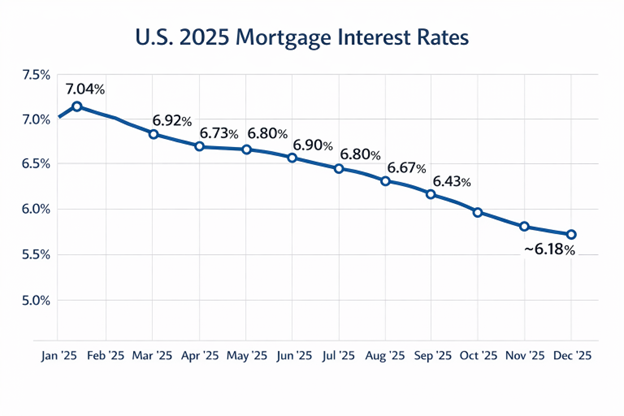

NOTICE: The information shown on the graph above was obtained from a public source. It is solely a pictorial illustration and is not intended to be an offer for any specific interest rate.

Many mortgage sites will advertise ‘teaser’ interest rates designed to entice the viewer to click through. If it looks too good to be true…you know the rest.

Posted teaser rates most often include “points” or “subject to” conditions that aren’t discovered until you read the fine print which usually isn’t found until after you click through.

Telling the Truth Upfront matters. I personally dislike being misled, even a little. Savvy people develop a gut feeling or instinct that tells them, this is too good to be true. A gut instinct is developed over time from actual experiences. If your gut instinct is triggered when you read an advertised interest rate, you probably already know it’s not real. The following is helpful to know.

The truth is this: The market is an external factor that influences general interest rates. But, specific mortgage interest rates are determined on an individual basis. Each applicant’s personal financial history directly influences the bottom line interest rate they qualify for.

Lenders assess the risk associated with lending to each individual borrower by reviewing three key factors:

- Credit History: Their credit score is the most significant indicator of how reliably they have managed past debts. A higher score typically results in a lower, more favorable interest rate.

- Debt-to-Income (DTI) Ratio: This measures their total monthly debt payments against their gross monthly income. A lower DTI ratio means they have more capacity to handle new mortgage payments.

- Loan-to-Value (LTV) Ratio: This is the ratio of their mortgage amount to the appraised value of the property. A lower LTV (which means a larger down payment) often reduces the lender’s risk and can lead to a better rate.

If you get that gut feeling when you see published rates and you want the truth, call, email or message me. We’ll discuss interest rates and what rate you truthfully can qualify for. I hope this is helpful for you.

joe.bechtold at edgehomefinance dot com or 630-456-2368 (Note: The email address is written out that way to prevent bots from skimming email addresses.)